right around the corner, a story of million possibilities

Thoughts on Innovation, Economics and Opportunities

September 21, 2023 · 6 min read · essay, tech, philosophy

The problem is, uncertainty.

As humans, we’ve been fighting with this for a long while. We try to make Everything around predictable. predictability is safe, predictability is iterable, predictability is controllable. This is true for the innovation of fire, as it is, to Settling down at a farm. We wanted to reliably have, fire, food and shelter. This is also the reason why people hate new Changes, “new” is unknown ergo unpredictable so should be kept away. Because of this, we end up going to the same McDonald’s that we go a million times over.

We’ll come back to McDonald’s in a second.

But, before that an economics lesson on price elasticity of supply and Cournot Competition Economics. Products with high price elasticity will see wider fluctuations in demand. This is, in contrast to products/services that are inelastic having lesser fluctuating demand. And according to the (mildly flawed) Cournot’s competition model, companies offering the same product will end up competing their profits away.

One way to think about this is that, every product/service has an acceptable range of price fluctuation. But, as we get to the lower bounds of price it becomes very inelastic and demand stops fluctuating. Unless something unexpected happens, breaking market’s equilibrium (like covid) because everybody who want it, is buying it, because it can’t get any cheaper. We’ve attained peak market optimisation, competitors have competed all their profits away, everybody is happy (Well, the business owner is obviously not).

Everything will be stable at that point, this is one reason why egg prices are better economic indicators than impossible burgers. This seems incredible when we apply to products, but the sad reality is that this is true of highly competitive labor markets as well. This is because in highly competitive markets, the profits (base wage + surplus) are completely competed away and people are only left with the base wage. And, unlike in Cournot’s competition model, Cooperation between entities is very hard. Especially in uncoordinated markets. Unions are a sort of Sybill attack on Capital gatekeepers, but that’s a story for some other day.

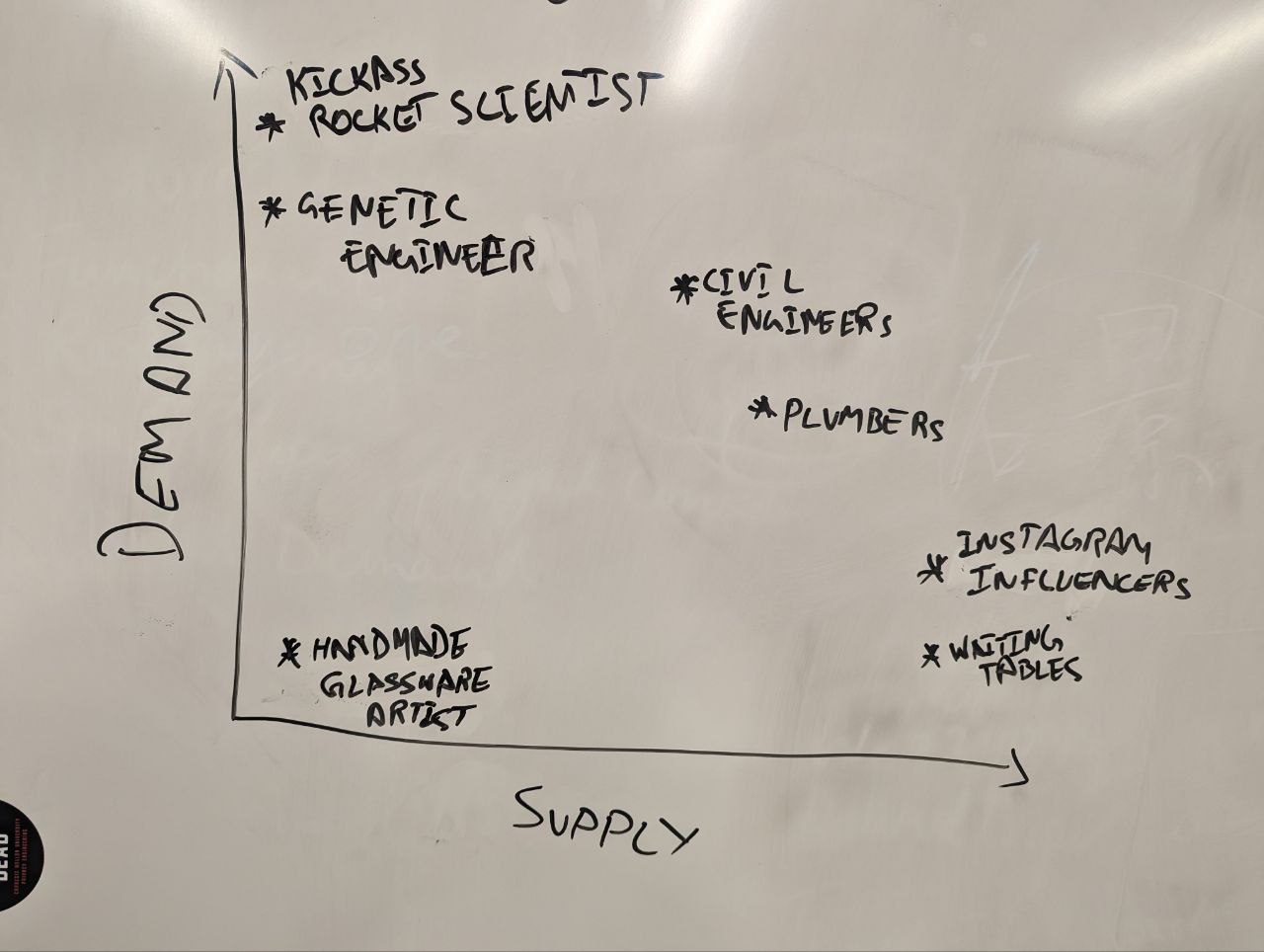

If we plot a demand vs supply graph for a typical job like Waiting tables, the supply is very high (Anybody can do it) and demand is very low (Anybody can do it). here’s a scaleless plot for a bunch of jobs based on my knowledge.

Every knowledge based job starts at the top left and then slowly progresses towards the middle, and stays there, if people are lucky. The movement speed is incredibly dependent on how difficult it is for people to train people. For example, “delivery gig work” started at the top left and moved to the right in under a decade, incredible. Because the know how for becoming a delivery agent is very low. As the job moves towards the right of the curve, it becomes incrementally harder for the practitioner to see any profit (i.e. stable life, holidays, bonus, dignity etc.). But, job markets operate in waves that have a granularity of a decade, which means it takes about a decade and a half for supply readjustment. And the job to climb back.

What does this imply for a person trying to navigate the employment economy?

From the above graph, It is obvious where the opportunities are abundant. It’s the top left.

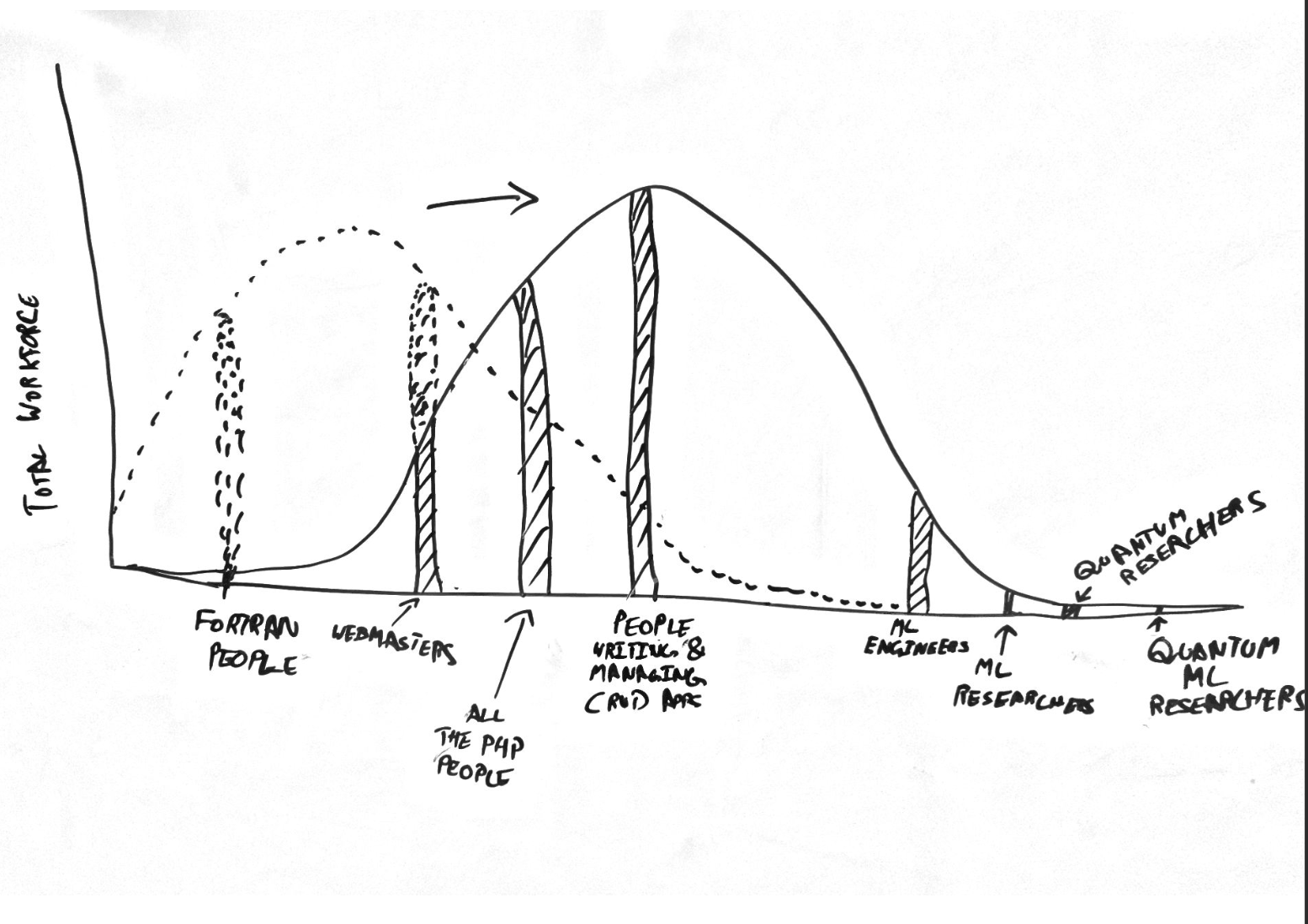

I made a broad generalisation in the above graph, putting all occupations in the same graph. But realistically, it is impossible to be a civil x Genetic engineer in the same life. To make decisions at that level, we need to get one level granular. let’s take a wide field like, software engineering, where things are being constantly marched on, The years 1980 - 2035 can be plotted as,

The dark lined graph is where we are right now, and the dotted line was where we were. just like in the supply demand graph. Jobs start with a very few people doing something in a high demand market, which then invites a lot of people, driving the prices down. know that this graph is a generalization, in reality this graph would be constantly active and adjusting based on the market demand.

Notice the right end of the graph, where there are very few practitioners? This is the place where you would want to be. The On-demand minority. But, the problem is that being the edge of anything comes with a risk, You are potentially betting yourself onto something That might be a great thing or a dud. For a lot of people this is the part that is scary because uncertainty has always been pushed away and nobody wants to deal with the uncertainty of having to figure out what the future looks like. So, most people tend to get coagulated in the middle where, something is the “common wisdom” and end up doing what everyone else is doing, thereby making it difficult for everyone.

In an ideal scenario we stay in the left end, It’s okay to move up and down. within the left.

If you somehow entered the market when something started growing, and rode it till the end. Yaay! to you, you can call yourself talented and retire with a lot of money. But, typically, when we start working we don’t time what we get into, the market does. Hence, it is difficult to actually predict what the future looks like.

But, There is actually a sweet spot between when something is a pretty small tight-knit community and a huge opportunity. Timing it and being prepared for it requires bets into the future on our actions. But, it is actually easier to do than having to fight for the last bone, stuck in the middle.

This requires being sensitive to the market and it’s changes making sure we are just a little ahead of the curve, this means making sure you are at a position where such an opportunity can be sensed ahead of time, knowing the “market makers” who dictate which direction the winds blow and being there when it happens. Obviously a lot of times, the bets are going to turn out to be a dud. This does not mean that you’re a grifter going from crypto to gen-AI and the next cool thing because then you’re just a snake oil salesmen with no belief.

Basically we have two choices, take the “popular opinion”, cross our fingers and hope we are not in the middle. But to me, actively running towards the front is a better strategy because it puts more variables onto my hands. I guess, it’s a personal preference.